The Swan Defined Risk U.S. Small Cap Fund

Applying the DRS to U.S. Small Cap Companies

The Swan Defined Risk U.S. Small Cap Fund seeks to address common investor concerns, such as seeking growth while mitigating risks when investing in small to mid-sized companies in the United States via the Russell 2000 Index ETF (IWM).

The fund allows investors to seek participation in growth opportunities of small-cap stocks while also seeking to dampen losses during periods of major market losses that can be experienced when investing in these smaller, growth-oriented companies.

Navigating market uncertainty. Capitalizing on market weakness.

The market is unpredictable, making it difficult to plan long-term outcomes.

That’s why we believe reducing downside risk can help smooth out returns over market cycles and taking advantage of opportunities in times of extreme market weakness can significantly impact wealth creation over the long term.

With this in mind, we developed our Defined Risk Strategy in 1997 as a way to offer our clients a distinctive, innovative hedged equity approach that remains passively invested in equities to pursue long-term growth of capital while actively managing the hedge to capitalize on large moves in the equity market: raising the hedge level after large gains and unlocking the hedge value to buy more equity shares after large market declines.

Class A: SDCAX | Class C: SDCCX | Class I: SDCIX

Based on our Defined Risk Strategy, the Swan Defined Risk U.S. Small Cap Fund seeks superior risk-adjusted returns over a full market cycle with potentially less downside risk and volatility than the fund benchmark, Russell 2000 Index. See the disclosures below for more information.

The goal: is to achieve long-term growth of capital, while minimizing the downside risk of U.S. Small Cap equity markets.

Key elements of our Always Invested, Always Hedged strategy include:

> Always invested using low-cost ETFs

> Designed to seek long-term growth of capital

> Always hedged using long-term put options

> Aims to dampen losses during major market downturns

Fact Sheet

Prospectus

Defined Risk Strategy

Other Defined Risk Funds

Invest in Equities

- Always Invested in ETFs or a basket of stocks that closely represent the Russell 2000 Index

Hedge the Equities

- Always Hedged by actively managing long-term put options (LEAPs), generally one to two years to expiration, initially

- Purchased at, or near near-the-money

Seek Additional Return

- Actively managing shorter-term options portfolio

- Utilizing a disciplined, time-tested approach

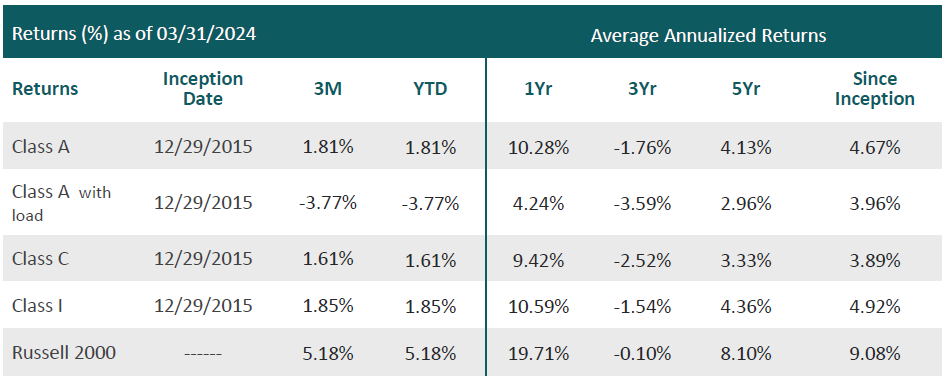

Performance shown is historical and does not guarantee future results. Current performance may be lower or higher. Because share price, principal value, and return will vary, you may have a gain or loss when you sell fund shares. Performance assumes the reinvestment of dividends and capital gains. “Without sales charge” performance does not reflect the current maximum sales charge. Had the sales charge been included, the Fund’s returns would have been lower. Class I shares have no sales charge and may be purchased by specified classes of investors. The Russell 2000 Index is designed to measure the equity market performance of U.S. small-cap to mid-cap companies. You cannot invest directly in an index or average. For performance information current to the most recent month end, please call (877) 896-2590. Maximum sales charge for Class A Shares is 5.50%. The fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the fund, at least until November 1, 2024. Please review the fund’s prospectus for more information regarding the fund’s fees and expenses.

Randy Swan

Lead Portfolio Manager, Founder, President

Rob Swan

Portfolio Manager, Chief Operations Officer

Chris Hausman, CMT®

Senior Portfolio Manager, Managing Director-Risk

Randy Swan and Rob Swan have been managing the Funds since inception.

Swan Capital Management

1099 Main Avenue, Suite 206

Durango, Co 81301

Tel: 970.382.8901

Gemini Fund Services, LLC

PO Box 541150

Omaha, Ne 68154

877.896.2590

Direct Contacts

For general questions or support

Toll Free

P: 866-617-7926

E: Email Client Services

For advisors or institutions with questions

P: 970-382-8901, ext. 114

E: Email