The Swan Defined Risk Emerging Markets Fund

Applying the DRS to Emerging Markets Companies

The Swan Defined Risk Foreign Fund seeks to address common investor concerns, such as seeking growth while mitigating risks when investing in equity markets of emerging and developing nations while hedging overall market risk.

The fund allows investors to seek participation in growth opportunities of emerging market stocks while also seeking to dampen losses during periods of major market losses that can be experienced when investing in the dynamic and at times volatile developing world.

Navigating market uncertainty.

Capitalizing on market weakness.

The market is unpredictable, making it difficult to plan long-term outcomes.

That’s why we believe reducing downside risk can help smooth out returns over market cycles and taking advantage of opportunities in times of extreme market weakness can significantly impact wealth creation over the long term.

With this in mind, we developed our Defined Risk Strategy in 1997 as a way to offer our clients a distinctive, innovative hedged equity approach that remains passively invested in equities to pursue long-term growth of capital while actively managing the hedge to capitalize on large moves in the equity market: raising the hedge level after large gains, or unlocking the hedge value (sell high) in to buy more equity shares after large market declines (but low).

SWAN DEFINED RISK EMERGING MARKETS FUND OVERVIEW

Class A: SDFAX | Class C: SDFCX | Class I: SDFIX

Based on our Defined Risk Strategy, the Swan Defined Risk Emerging Markets Fund seeks superior risk-adjusted returns over a full market cycle with potentially less downside risk and volatility than the fund benchmark, MSCI Emerging Markets Index. See the disclosures below for more information.

The goal: is to achieve long-term growth of capital, while minimizing the downside risk of foreign equity markets.

Key elements of our Always Invested, Always Hedged strategy include:

> Always invested using low-cost ETFs

> Designed to seek long-term growth of capital

> Always hedged using long-term put options

> Aims to dampen losses during major market downturns

Fact Sheet

Prospectus

Defined Risk Strategy

Other Defined Risk Funds

Invest in Equities

- Always Invested in ETFs or a basket of stocks that closely represent the MSCI EEM Index

Hedge the Equities

- Always Hedged by actively managing long-term put options (LEAPs), generally one to two years to expiration, initially

- Purchased at, or near near-the-money

Seek Additional Return

- Actively managing shorter-term options portfolio

- Utilizing a disciplined, time-tested approach

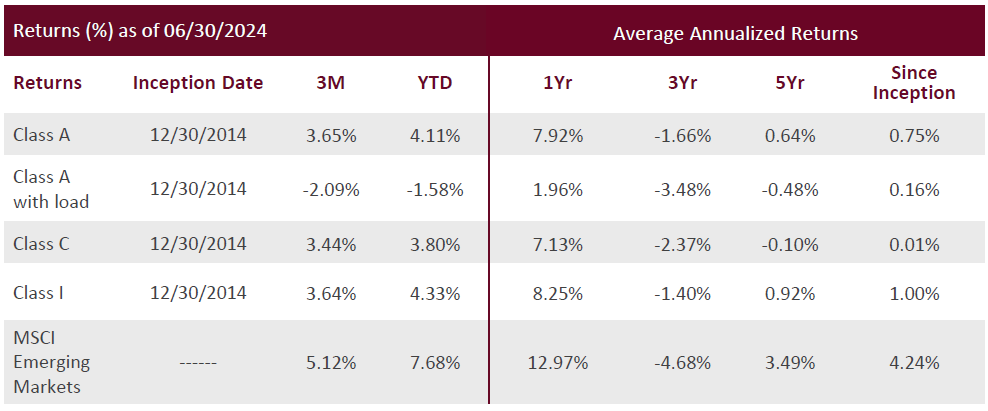

PERFORMANCE

Performance shown is historical and does not guarantee future results. Current performance may be lower or higher. Because share price, principal value, and return will vary, you may have a gain or loss when you sell fund shares. Performance assumes the reinvestment of dividends and capital gains. There is no assurance the fund will pay dividends or capital gains in the future. “Without sales charge” performance does not reflect the current maximum sales charge. Had the sales charge been included, the Fund’s returns would have been lower. Class I shares have no sales charge and may be purchased by specified classes of investors. The MSCI (Morgan Stanley Capital International) Emerging Markets Index is designed to measure equity market performance in global emerging markets. You cannot invest directly in an index or average. For performance information current to the most recent month end, please call (877) 896-2590. Maximum sales charge for Class A Shares is 5.50%. The fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the fund, at least until November 1, 2024. Please review the fund’s prospectus for more information regarding the fund’s fees and expenses.

Randy Swan

Lead Portfolio Manager, Founder, President

Rob Swan

Portfolio Manager, Chief Operations Officer

Chris Hausman, CMT®

Senior Portfolio Manager, Managing Director-Risk

Randy Swan and Rob Swan have been managing the Funds since inception.

Swan Capital Management

1099 Main Avenue, Suite 206

Durango, Co 81301

Tel: 970.382.8901

Gemini Fund Services, LLC

PO Box 541150

Omaha, Ne 68154

877.896.2590

Direct Contacts

For general questions or support

Toll Free

P: 866-617-7926

E: Email Client Services

For advisors or institutions with questions

P: 970-382-8901, ext. 114

E: Email